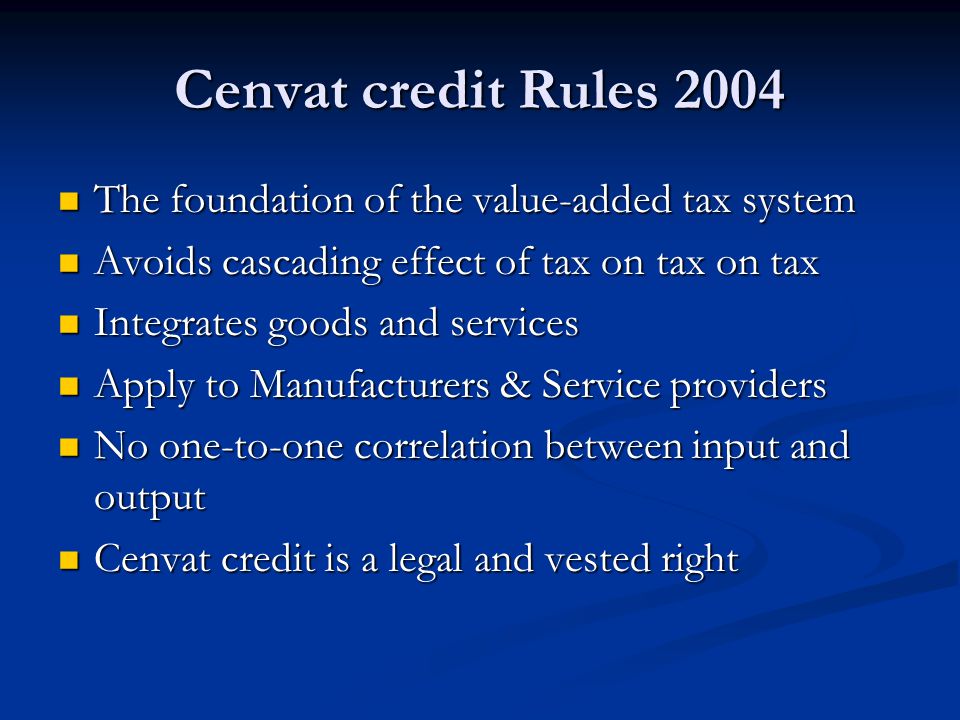

10+ Service Tax Cenvat Credit Rules 2004

Service Tax Case Laws. Thus the service recipient must directly deposit service tax on GTA through GAR-7.

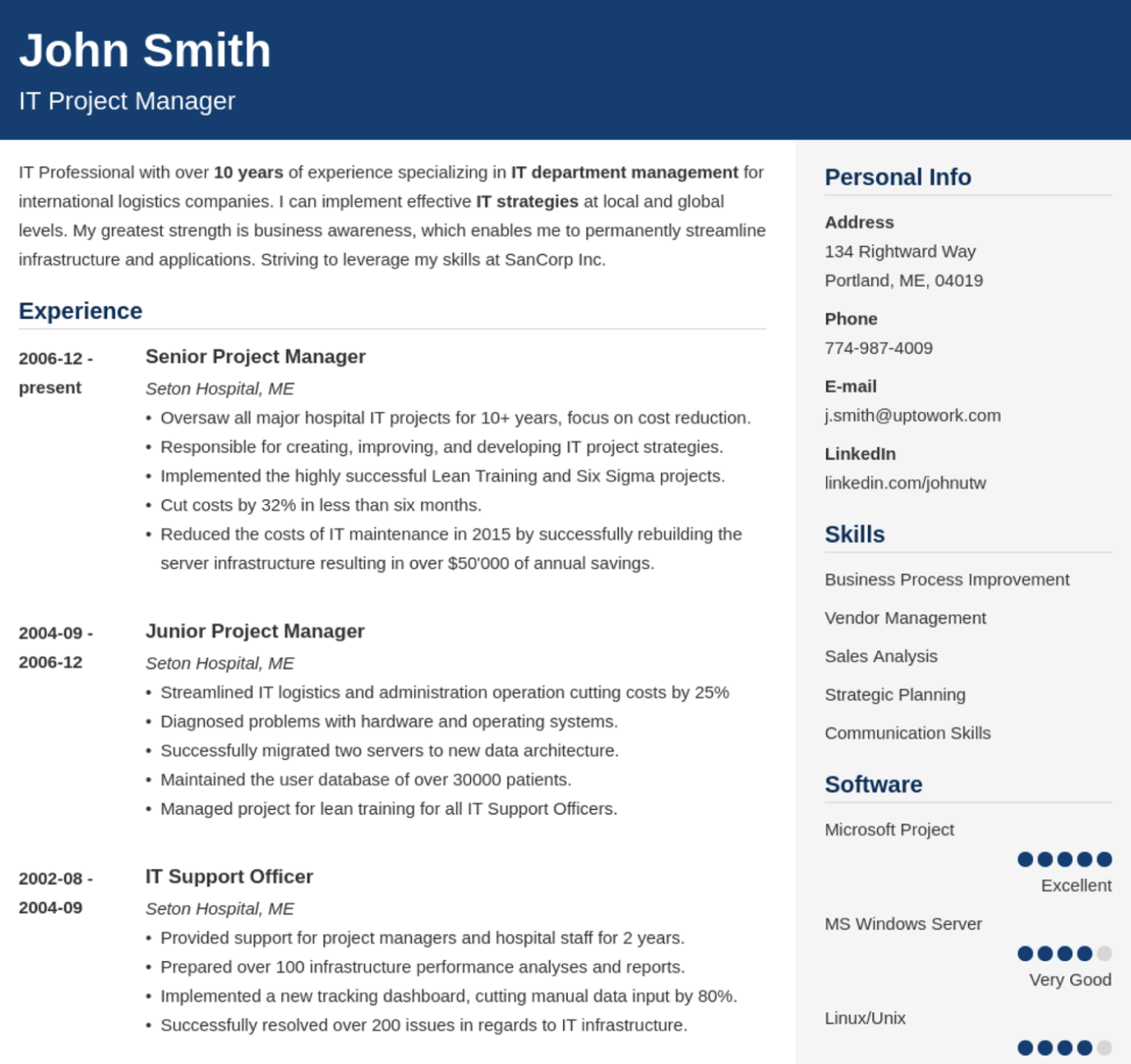

500 Resume Examples Good Resumes For Any Job 2022

Web Chapter V of the Finance Act 1994 Service Tax Finance Act 1979 21 of 1979 from section 33 to 48 Foreign Travel Tax Finance Act 1989 13 of 1989 from section 40 to 49 Inland Air Travel Tax GST Rates Rules.

. 26-11-2019 - Seeks to notify the transition plan with respect to JK reorganization wef. Taxation of Services Ed. Web For all transactions under Central Excise and Service Tax use the Tab ACES CEST Login.

Taxation of Services Ed. Transport of passengers by air with or without accompanied belongings. Web Delhi Value Added Tax Act 2004.

Service Tax - Acts. Web Service Tax - Ready Reckoner. Service tax VAT Returns.

Web Rule 39 - Procedure for distribution of input tax credit by Input Service Distributor - Central Goods and Services Tax Rules 2017. Service Tax Case Laws. Web Service Tax - Ready Reckoner.

Service Tax Case Laws. Cenvat Credit Rules 2004. Web No the service recipient is not allowed to utilize cenvat credit for payment of service tax under reverse charge.

Service Tax Case Laws. Hence the rate of tax applicable on supply of these contract services is 9 CGST SGST each. Service Tax Case Laws.

Web 10th September 2004. Cenvat Credit - R. Cenvat Credit Rules 2004.

Service Tax Case Laws. Service Tax Case Laws. Cenvat Credit Rules 2004.

Taxable Services upto 30612. Service Tax - Manuals. Service Tax Case Laws.

Web 102020 - Dated. Cenvat Credit Rules 2004. Reversal of input tax credit in the case of non-payment of consideration.

Cenvat Credit - R. The Cenvat Credit Rules 2004. Web In the memo of appeal and during the course of hearing of appeal learned Counsel for the appellant Shri Prabhat Kumar has submitted that in view of Rule 2M and Rule 7 of CENVAT Credit Rules 2004 the ISD receives invoices under Rule 4A of the Service Tax Rules 1994 towards purchase of input services and issues challans for the.

Taxable Services upto 30612. Of Rajasthan amends Schedule II in Rajasthan VAT Act 2003 to delete Entry No. Provided also that credit of input tax charged on goods and services used in supplying the service hasnot.

Cenvat Credit - R. Taxable Services upto 30612. Beyond the place of removal during the period from October 2015 to September 2016.

Procedure for distribution of input tax credit by Input Service Distributor. Claim of credit by a banking company or a financial institution. 13-1-2020 - Seeks to appoint Revisional Authority under CGST Act 2017.

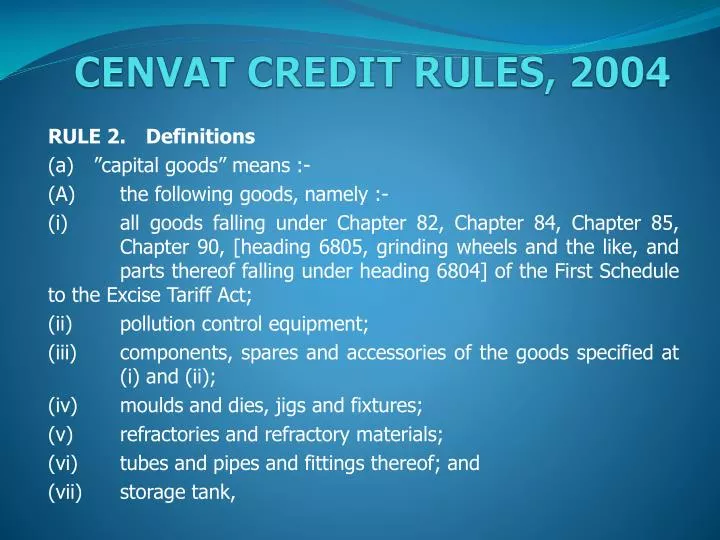

600E-In exercise of the powers conferred by section 37 of the Central Excise Act 1944 1 of 1944 and section 94 of the Finance Act 1994 32 of 1994 and in supersession of the CENVAT Credit Rules 2002 and the Service Tax Credit Rules 2002 except as. Taxable Services upto 30612. The debit note speaks only of reimbursement of expenditure and says nothing about the rendition of any services.

Cenvat Credit Rules 2004. Service Tax - Acts. Cenvat Credit Rules 2017.

Service Tax - Acts. Limited Liability Partnership Rules 2009. READ MORE READ.

Taxation of Services Ed. Service Tax - Manuals. Taxation of Services Ed.

Cenvat Credit Rules 2004. Corporate Laws Rules. Web Governor of Bihar amends the Bihar Tax on Entry of Goods into Local Areas Rules 1993 and Bihar Advertisements Tax Rules 2007 the Bihar Taxation on Luxuries in Hotels Rules 1988.

Web Service Tax - Ready Reckoner. Service Tax - Acts. Taxable Services upto 30612.

You will be eligible to enjoy CENVAT credit as Central Tax on your stock if you have invoices or other prescribed documents evidencing payment of excise duty under the existing law and such invoicesprescribed documents were issued not earlier. Web On the basis of information called from the Appellant it was observed that the Appellant had availed the Cenvat Credit of Service tax paid on outward GTA services used for transportation of their finished goods from their factory to customers premises ie. Web Documentary requirements and conditions for claiming input tax credit.

8D of the Income-tax Rules 1962 as no exempt income was earned by the assessee during the year under reference ie AY. Web Further the respondent invoked the extended period of limitation under proviso to Section 11A1 of the Central Excise Act 1944 hereinafter referred to as the CEA 1944 alleging that the assessee suppressed the fact of availment of Cenvat credit on the service tax paid on lease rentals operations and maintenance charges o f. 21-3-2020 - Special procedure for certain processes - ascertain the tax period - payment of tax - availing ITC.

Web Disallowance us 14A in accordance with Rule 8D - Expenditure incurred on earning exempt income - HELD THAT- No disallowance of expenditure could be made by the AO in the case of the assessee us 14A of the Act rwr. Explanation to Rule 34 of Cenvat Credit Rules 2004. Web Provisions of paragraph 2 of this notification shall apply for valuation of this service 075 Provided that the central tax at the rate specified in column 4 shall be paid in cash that is by debiting the electronic cash ledger only.

Web i CENVAT credit on any goods classifiable under Chapters 1 to 22 of the Central Excise Tariff Act 1985 5 of 1986 used for providing the taxable service has not been taken under the provisions of the CENVAT Credit Rules 2004. Web Service Tax - Ready Reckoner. Taxation of Services Ed.

Service Tax - Manuals. Oil Companies wef June 25 2020. Cenvat Credit - R.

Service Tax Case Laws. Rule 92 in turn refers to the Service Tax Rules 1994. Finance Acts Ordinances.

Service Tax - Manuals. 242022-Central Tax-Seeks to make fourth amendment 2022. Classification of services - rate of tax - works contract service - The structures constructed by the applicant will be used for the purpose of business and therefore these contracts are not qualified for concessional rate of tax made to Government Entity.

Cenvat Credit - R. Maharashtra Value Added Tax Act 2002 West Bengal Value Added Tax Act 2003. Web Information - Service Tax Acts Rules Forms Notifications Circulars Instructions Guidelines Orders.

Web CESTAT Delhi held that in terms of the provisions of Rule 2m and Rule 7 of the CENVAT Rules before 01042016 the Principal Manufacturer as an Input Service Distributor is facilitated to distribute cenvat credit in respect of service tax paid on the input services to its Contract Manufacturing Unit working on job work basis. Thus even in terms of the provisions of rule 2m and rule 7 of the CENVAT Rules as they stood prior to 01042016 the appellant could distribute CENVAT credit in respect of the service tax paid on inputs services to its manufacturing units including a job workers. 232004-Central Excise NT GSR.

Web There was violation of Rule 9 of the CENVAT Credit Rules 2004 hereafter CCR 2004 as the debit note was not a document specified in Rule 9. Web Service Tax - Ready Reckoner. Service Tax Case Laws.

Service Tax - Acts. Proviso to Rule 9. Service Tax - Manuals.

Workforce One Wf1 Connect Mobile App Fusion Learning Partners

Cenvat Credit Third Amendment Rules 2016

10 Best Accountants In Burwood Melbourne 2022

Full Article Turkey S Employment Subsidy Program Under The Great Recession A General Equilibrium Assessment

Ppt Cenvat Credit Rules 2004 Powerpoint Presentation Free Download Id 794047

Cenvat Credit Rules 2004

Cenvat Credit Rules 2004 Eligible Duties Rule 3 Duties Taxeslevied Under A Basic Excise Duty Bed Levied On Excisable Goods And Additional Duty Ppt Download

Cenvat Credit Rules 2004

Cenvat Credit Rules 2004 Eligible Duties Rule 3 Duties Taxeslevied Under A Basic Excise Duty Bed Levied On Excisable Goods And Additional Duty Ppt Download

3 Input Of Oil To The Sea Oil In The Sea Iv Inputs Fates And Effects The National Academies Press

Bank Run Wikiwand

Cenvat Credit System Features And Principles Ppt Video Online Download

Cenvat Credit Rules 2004 Eligible Duties Rule 3 Duties Taxeslevied Under A Basic Excise Duty Bed Levied On Excisable Goods And Additional Duty Ppt Download

Ppt Cenvat Credit Rules 2004 Powerpoint Presentation Free Download Id 794047

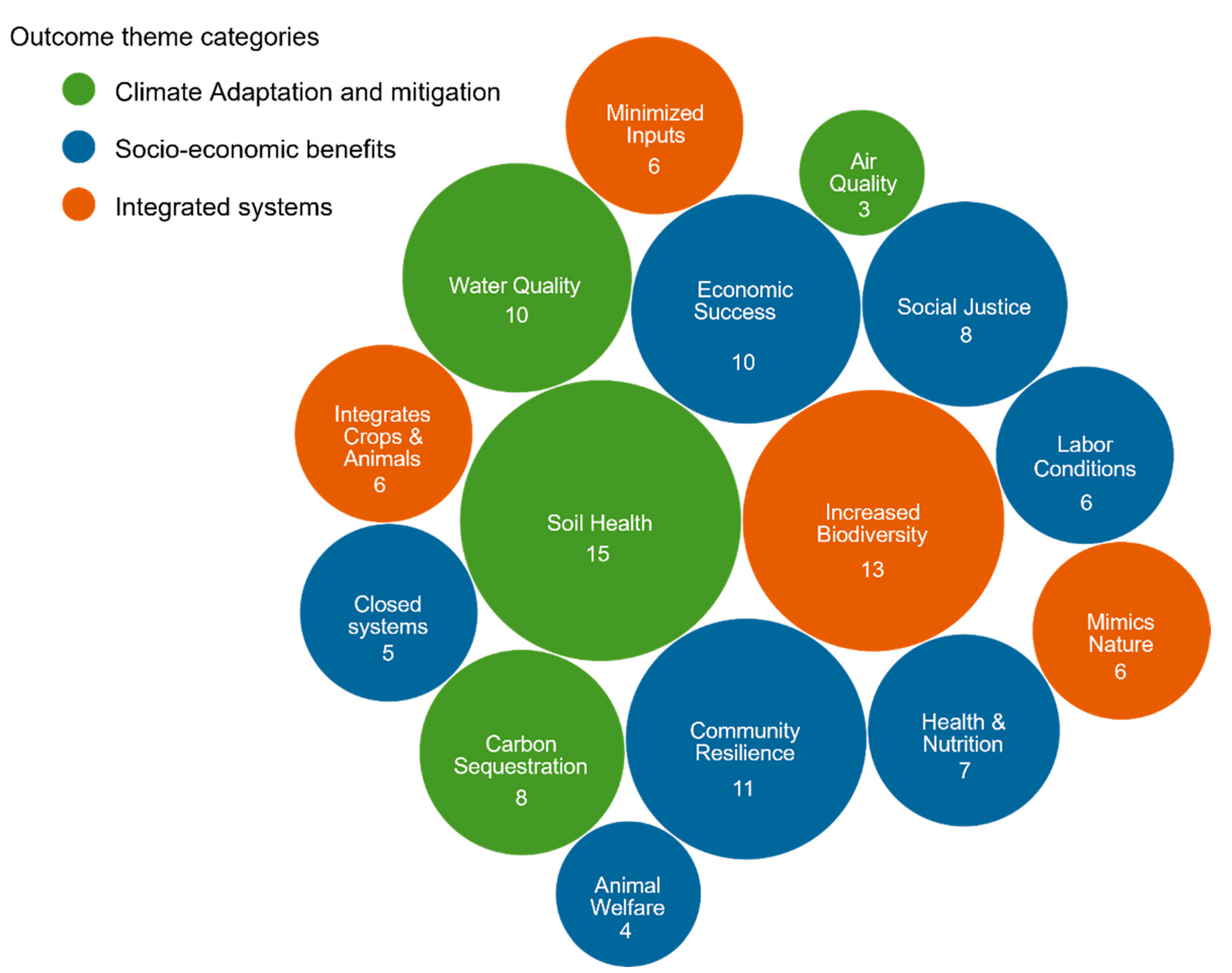

Sustainability Free Full Text Different Stakeholders Rsquo Conceptualizations And Perspectives Of Regenerative Agriculture Reveals More Consensus Than Discord Html

Amazon Com Oontz Upgraded Angle 3 Bluetooth Speaker Portable Bluetooth Speakers Powerful 10 Watt Output 100 Foot Wireless Bluetooth Range Extended Battery Life Water Resistant Ipx5 Electronics

Sony Rootkits And Digital Rights Management Gone Too Far Microsoft Community Hub